NPC Service

Putting the service back in Merchant Services

Putting the service back in Merchant Services

This year, credit card processing companies as well as third-party network payments such as PayPal, Amazon.com and Google are required to report to merchants and to the Internal Revenue Service the gross amount of the transactions they’ve processed. This is due to the federal Housing Assistance Tax Act of 2008 which included the enactment of Section 6050W of the Internal Revenue Code. This federal regulation will be used to help the IRS identify under-reported payment made to merchants by credit and debit card.

The credit card processor is required to monitor your processing volume during the year and submit to the IRS the 1099-K that includes your gross sales for the year as well as a breakdown for each month. Many processors are charging a fee for this, we have seen anywhere from $4.95-$20.00 per month to $100.00 or more annually! Many processors are calling this a Regulatory Fee as the IRS made it illegal to charge directly for the 1099-K.

Your processor is required to send to you a 1099-K form by February, 15th and report your gross processing volume to the IRS by February, 28th.

The IRS requires that you report your gross credit card sales and net processed for tax collection purposes. Reconciling your gross sales (which is the figure reported to the IRS) to net sales (the net amount funded to your account) may be difficult. This site and our knowledgeable staff are here to help. We also need you to verify that we have your correct TIN (Tax Identification Number) and Legal Name for your business in our file through one of the following methods:

Reviewing your tax records (including your SS-4, IRS peel-off tax label, various tax returns)

Verify information with your accountant or tax advisor

Contact the IRS directly at 1-800-829-3676 and request Form 147-C

NPC has created a program called R.A.A.P. or the Regulatory Accounting Assistance Program to make 1099-K reporting a breeze. It reports your gross and net processing volume, the two major components to complete your 1099-K form. Determining the gross vs net volume can be an accounting challenge for many merchants and their tax preparers, for example, if you issue refunds, returns or have had any chargebacks, the gross amount reported on your 1099-K will differ from the net volume deposited to you. The design of our Regulatory Accounting Assistance Program is to simplify the process of completing your 1099-K form and ensure you don’t make any mistakes. Mistakes can result in an IRS audit or possibly withholdings of 28% of your future credit card processing volume.

Name, business name, address, TIN – Taxpayer Identification Number

Offers Gross sales and Net ‘Profit’ from including deductions and expenses

Actual figures reported to the IRS (NO MISTAKES!)

Details amounts by card type, explains any differences and traces them to the statement

Access previous 1099-K reports for three prior years

With National Payment Corporation, you do not need to cough up every business document you have to get approved to accept credit cards. We won’t force you to take pictures of your inventory either! If you have a retail business, you will simply need to supply us with your business address, some basic personal information, and a voided business check. We can have your account approved within 24 hours! The application process itself just takes a few moments. If you are applying for a MO/TO or Online account, the application process is the same, we may request some additional info if your volume is extra-ordinary. Call National Payment Corporation today to find out how easy we will make this for you!

Already accepting credit cards? Call National Payment Corporation today to learn why 84% of our current client base was originally set up with another processor! A National Payment Corporation specialist will provide you with a more competitive rate plan, describe our exception service and technical support, and begin your seamless and easy transfer to National Payment Corporation!

Unexpectedly need some cash for your business? Time to launch a new product but you don’t have the funds to support it? Does your store need renovations or maybe you are ready to take your business to the next level? National Payment Corporation has the answer. We can get you the cash you need, NOW! The money can be paid back over time using your credit card transactions. Call a National Payment Corporation representative to learn more right now!

Improved Cash Flow – Repayment is Through a Percentage of Your Future VISA/MasterCard Receipts You Pay Us Only When You Make a SaleDoes Not Affect Your Ability to Qualify for Other FinancingUse the Cash Advance for Any Business PurposeState-of-the-Art Processing Systems Maximize Transaction Security.

Apply in Less Than 10 Minutes! Over 90% Approval Rate

National Payment Corporation is COMMITTED to providing you, our customer, with honest merchant processing at very competitive rates. We understand the industry as well as some of the antics companies may use to promote their products. Have you ever been told a very low rate plan while the ‘other’ fees were left out. Things like a monthly minimum or batch fee? The fees that are ‘left out’ are often the ones that will cost you the most money each month. Don’t get pick-pocketed, be thorough. At National Payment Corporation, we have a No Hidden Fees Policy that assures every client that we explain each program in its entirety. No surprises, just honest and up front plans.

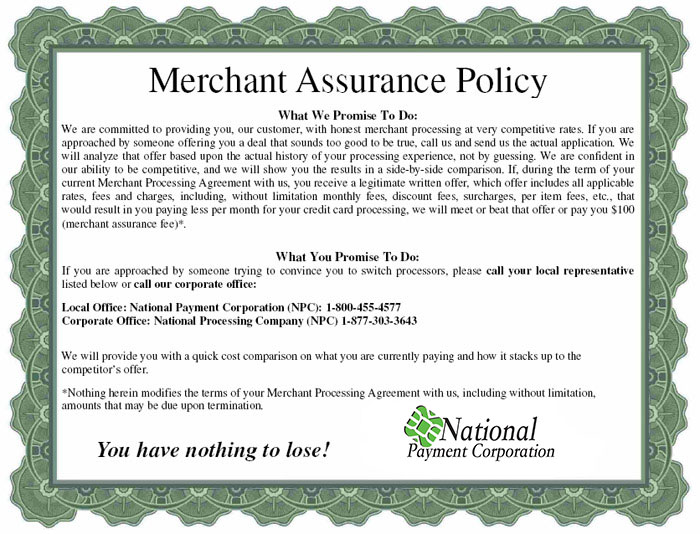

Once you have chosen to set your account up with National Payment Corporation, we will extend our Merchant Assurance Policy to you. It states that if you are approached by another provider with a deal that sounds too good to be true (like a free credit card machine!), we will give you $100.00 if our program can’t meet or beat it! To take a look at the details of this offer, click here.

Many providers will dance around a program and focus on one rate, the lowest one they can offer you. What you really need is the whole picture. When you bought your last car, I am sure you negotiated a number of things, the price of the car, the term of payments, the interest rate, warranties, etc. You would never purchase a car on just an interest rate alone! The reason of course is that there are more factors needed than just the rate to determine your loan payment. The Merchant Service industry is no different. When the next sales rep smiles and says, I can save you money! Think twice, get all of the paperwork and fax it to us. We will provide you with a side by side based on your actual processing. Let us do the work for you, then show it to you in black and white.

Our goal in all of this is to simply prove to every one of our clients that we provide the most up front and honest credit card processing at the most competitive prices available. It is our hope that you take the time to discuss a program with one of our experienced account representatives or take advantage of the information available in this site. We want your business, today and for years to come!

MasterCard and Visa each have a program that was developed to eliminate some of the processing fees for pre-certified businesses. These businesses range from governments, education entities, and other emerging markets. With MasterCard and Visa’s approval for this program, your business will save a substantial amount of money by eliminating the discount rate your currently, or would have, paid.

To set up with this program, your business must enroll using the NPC Secure software program. This Access/Convenient Payment will be charged as a second transaction back to the cardholder to cover interchange, assessments, and any other processing fees. Your business will not pay interchange, dues, assessments, or any other fees on that particular transaction.

MasterCard and Visa approve select business types with the ability to use the Access/Convenient Payment based on their SIC code and products or services for sale. If you would like to begin using this program, NPC will correspond directly with MasterCard and Visa on your behalf.

This program cannot be confused with a surcharge. A surcharge is any fee charged in connection with a credit card transaction that is not charged if another payment method is used. The Access/ Convenient Payment is a fee charged to justify particular business cases that provide ease and expediency of payment. Your business should have the ability to participate in the program and be permitted to assess a convenient payment provided that the conditions set out below are satisfied.

The Fee is being charged for bona fide convenience of using an alternate payment channel outside of the Merchant’s normal business practice.